Medical Receivables Factoring - Tired of cash flow anxiety?

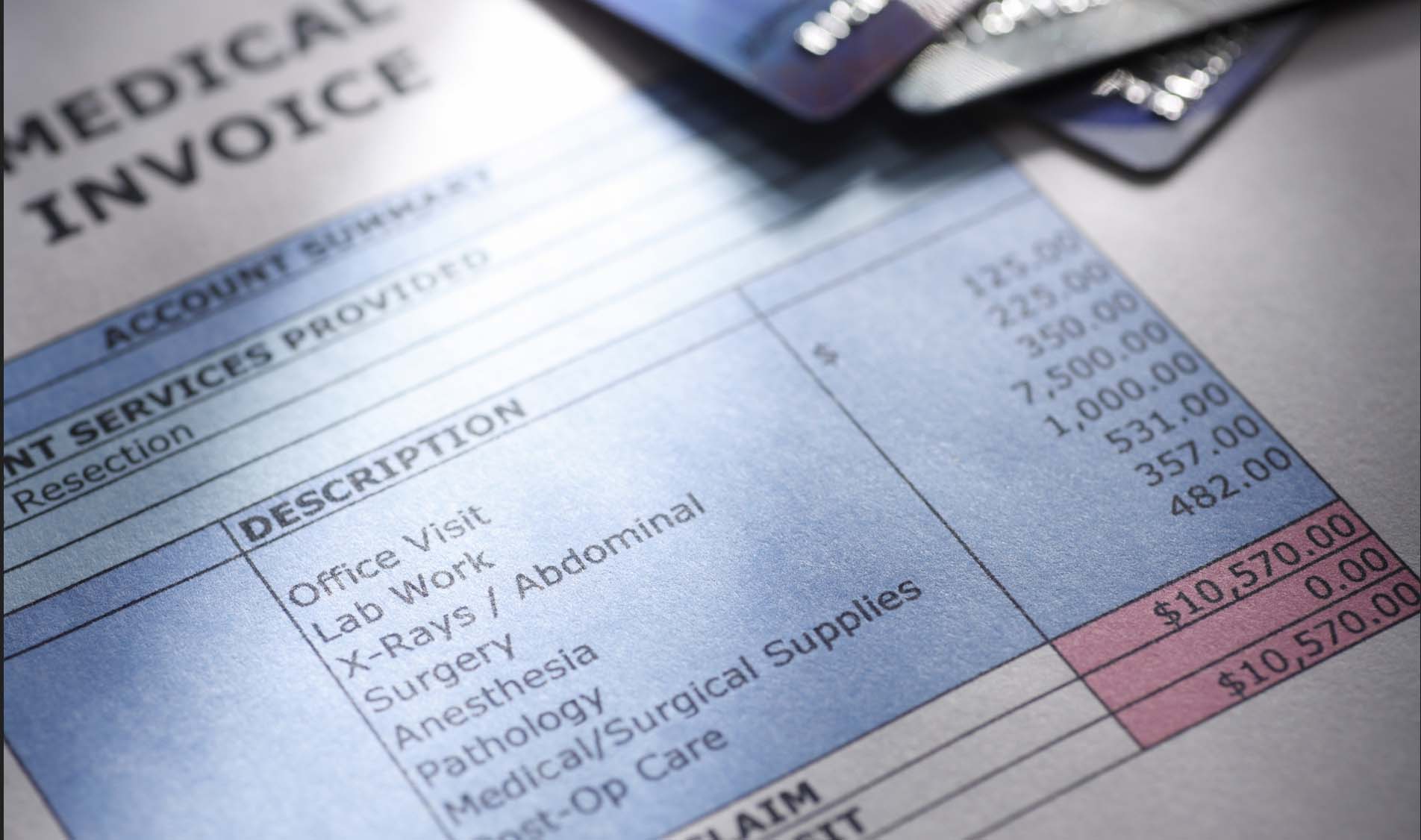

Medical Receivables Factoring provides a method to free up cash by selling your invoices at a discount. If you are offering quality invoices, invoices that you expect to be paid in the near future, then chances are good that a factoring company will buy your invoices for a discounted price. This will get you cash within 3 to 5 days instead of 3 months or more.

If you want to grow your practice, pay for staffing, buy new equipment or pay your malpractice insurance, then this may be what you're looking for.

Medical Receivables Factoring is not a loan. The sale of your accounts receivables creates no additional debt on your balance sheet.

Quality invoices include those that have been billed to various insurance companies who normally pay within 90 to 120 days. These "third party payors" include Medicaid, Medicare, HMO/PPO, Commercial Insurance and Private Insurance.

Many factoring companies will not buy accounts receivable that are self-pay (owed by patients directly) or long term payments from personal injury, workers compensation or no-fault accounts receivables. If the payment is expected in a shorter time frame, some factoring companies will consider buying medical accounts receivable invoices from personal injury, workers compensation or no-fault services.

Yet another source for quality invoices is from healthcare facilities that have contracted with you to provide your services to their facility.